Past PhAMAS EventsVisit the PhOTOS page to see more photos from these eventsPhAMAS Holiday PartyThis is a wonderful opportunity to relax, celebrate the season, and catch up with one another in a festive atmosphere. Date and Time: Venue: Details: Hors d'oeuvres, cocktails and conversation. Economic Data After the ShutdownDate: Monday, November 24, 2025 Time: The Shutdown delayed dozens of key data releases. With the shutdown over and the flow of economic data slowly returning to normal, how should analysts approach the economic calendar? And how should analysts make use of some of the alternative data sources that emerged during the shutdown? PhAMAS at the Phillies vs. New York Mets

Date: Wedesday, September 10, 2025 Time: Picnic starts at 5:15 pm. First pitch is at 6:45 pm. Location: Citizens Bank Park Sponsor: Thanks to BAM Mutual Fiscal New Year (Happy or Not?) 2026 Municipal Market OutlookAlthough it appears that the federal tax exemption for municipal bond interest is preserved (for now), the impacts of the O3BA, continued federal policy actions, and other market and political dynamics will make the 2026 Fiscal New Year one of multiple risks and opportunities for municipal market participants. Hear from seasoned municipal market experts – Tom Kozlik, Vikram Rai and Eric Kazatsky – about their insights, forecasts, and implications for the municipal market and sectors at our Fiscal New Year 2026 event, and in-person attendees only, stay for a networking reception!! Moderated by Mark Schmidt. Speakers: Tom Kozlik (PhAMAS co-founder and) Date: Thursday, July 31, 2025 Time: Location: ZOOM or Not-for-Profit Status Under Attack - Implications for Universities and Other 501(c)(3) Muni Market IssuersWhile the most high-profile threat to not-for-profit tax status has been targeted at Harvard University, the implications ring wide across the nonprofit sector. Hear from industry experts about 1) threats to and defenses by nonprofit sector entities including universities, housing agencies, environmental groups, research institutes, and healthcare organizations; 2) legal precedents and process for revoking 501(c)(3) status; 3) potential impact to bonds issued by nonprofit borrowers in the muni market if 501(c)(3) status is revoked. Speakers: Bill Rhodes Noel A. Fleming Date: Thursday, June 26, 2025 Time: Location: ZOOM or Geopolitical & Macro Risk Outlook: What it Means for Public FinancePlease join the Philadelphia Area Municipal Analyst Society and Academy Securities for our upcoming discussion. Please note, this event will be hosted in-person only and is not open to the press.Date: Thursday, May 29, 2025 Time: Location: Speaker: General Marks is the Founder and President of The Marks Collaborative, an advisory for corporate leader development, education and training and has led entrepreneurial efforts in global primary research and national security. He served over 30 years in the Army holding every command position from infantry platoon leader to commanding general and was the senior intelligence officer in the Balkans, Korea, and Operation Iraqi Freedom. He culminated his career as the Commanding General of the US Army Intelligence Center and School at Fort Huachuca, Arizona. He has been awarded the Distinguished Service Medal, the Defense Superior Service Medal, Legion of Merit with Oak Leaf cluster, Bronze Star, and multiple combat, expeditionary and service ribbons. General Marks is a Master parachutist, authorized to wear Korean and Canadian Airborne wings, Air Assault qualified, and Honor Graduate of the US Army Ranger School. General Marks is a national security contributor to CNN and member of the Military Intelligence Hall of Fame. Moderator: Ms. Ketchum is a Director at Academy Securities within the public finance group specializing in municipal credit analysis for issuers nationwide. Prior to joining Academy, Ms. Ketchum began her career in municipal finance as an analyst at Ambac Assurance, working with both the Housing and Northeast regions for 6 years. Post Ambac, Sara has worked as a municipal analyst for both Fitch Ratings and Wells Fargo Bank in New York City covering many North East Region issuers. Ms. Ketchum has a BS in Mathematics from Syracuse University, an MBA from Pace University, and has a Series 52 certification. Impacts of GASB Infrastructure ProposalDate: Thursday, March 27, 2025Time: Moderator: Panelists: Mid-Atlantic UpdateWe kick off PhAMAS’ 2025 program season with a discussion on the economic & fiscal outlook for the Mid-Atlantic region. Time: Location: ZOOM or Speakers: Nick Rizzo, Senior Analyst on the Mid-Atlantic Local Government Ratings Team, Fitch Ratings Ryotaro Tashiro, Outreach Economist and Advisor, Federal Reserve Bank of Philadelphia As an outreach economist and advisor, Ryo Tashiro travels across the Third District, speaking to various groups about the economic outlook and the functions of the Federal Reserve. He tries to avoid using economic jargon so that those without economic backgrounds can participate in the conversations. Ryo views these interactions with the public as two-way streets. Not only does he see the importance of informing the public about what is going on with the economy and at the Fed, Ryo also thinks it is important to hear what individuals across the District are experiencing in the economy. Many of the research topics Ryo has pursued were inspired by these conversations with the public. Those topics include his two main areas of focus, labor economics and demographics. Among his many contributions to the Bank, Ryo is notably responsible for the Chamber of Commerce for Greater Philadelphia Economic Outlook Survey. Moderator: PhAMAS at the Phillies vs. Chicago Cubs

Date: Tuesday, September 24, 2024 Time: Picnic starts at 5:00 pm. First pitch is at 6:40 pm. Location: Citizens Bank Park, Pass and Stow Lounge Sponsor: Thanks to Assured Guaranty Fiscal New Year 2025 Municipal Market and Political Outlook PLUS Networking EventDate: Thursday, July 25, 2024Time: 3:00 - 5:00 pm ET, followed by networking reception from 5:00 - 6:30 pm Location: ZOOM or In-person: Offices of Greenberg Traurig, 1717 Arch Street, Suite 400, Philadelphia, PA 19103 Description: As the 2025 Municipal Fiscal New Year begins, please join to learn insights from municipal market industry leaders Tom Kozlik (Hilltop Securities and former PhAMAS chair), Mark Schmidt (Morgan Stanley), and Liz Farmer (Pew Charitable Trusts Fiscal 50 Project), moderated by Alice Cheng (Janney, Montgomery, Scott). Bring your questions for this interactive discussion, then in-person attendees, please join us for lite bites and networking after the panel, hosted by Greenberg Traurig. Panelists: Moderator: Alice Cheng, Vice President, Municipal Credit Analyst, Janney Montgomery Scott Senior Living Communities Post-Pandemic: So Long, COVID or Soo Long COVID?Date: Thursday, June 27, 2024Time: 3:00 - 5:00 pm, followed by happy hour at nearby location from 5:30 - 7:00 pm NOTE: We will also have a networking event with light bites and beverages from 5:30 - 7:30 pm at The Devil's Alley, 1907 Chestnut Street, Philadelphia, PA 19103. Description: Even with labor pressures easing and occupancy rising at many facilities, the challenges facing the Life Plan Community (LPC) industry remain acute. Along the credit spectrum in the sector, bond defaults and impairments are accelerating at one end, while at the other end, mostly system-level operators are executing innovative collaborations and consolidations. What has ‘bounced-back’ after the worst of the pandemic? What new industry dynamics are here to stay? Hear from industry professionals about the current round of bond impairments, credit-impactful regulatory updates, regional real estate and competitive factors, management of rising insurance and other costs, and more. Also learn how system leaders operating in the Philadelphia-region (the birthplace of LPCs) and nationally are adjusting business models, collaborating and/or consolidating, and innovating for growth. Bring your questions for this exciting discussion and/or join us after the discussion for informal networking with beverages and light bites. Panelists: Margaret Johnson, Senior Director and Sector Lead, Life Plan Communities, Fitch Ratings Moderator: Lisa Washburn, Managing Director, Municipal Market Analytics 2024 Regional Economic UpdateDate and Time: Wednesday, March 20, 2024, 3:00 - 5:00 pm ET Description The Philadelphia Area Municipal Analyst Society (PhAMAS) is pleased to invite you to a panel discussion on the economic and financial outlook for the City of Philadelphia and the greater MSA including New Jersey. Jackie Dunn (Treasurer, City of Philadelphia) will provide an update on the FY2024 and FY2025 budgets, forward issuance calendar, and highlights of the Mayor’s key policy objectives. David Rousseau (a former New Jersey State Treasurer) will focus on the NJ Budget and South Jersey economic trends. Matt Colyar, an economist with Moody’s Analytics, will provide a brief overview of the macroeconomy, then focus more specifically on the Philadelphia MSA. Natalie Cohen (President, National Municipal Research) will serve as moderator. Moderator: PhAMAS 2023 Holiday PartyDate and Time: Wednesday, December 20 from 5:00 - 8:00 pm Location: Ladder 15, 1528 Sansom Street Philadelphia, PA 19102 What Every Analyst Needs to Know about Government Accounting - Presented by Dean Michael Mead~ Offered by PhAMAS in conjunction with the NFMA's Introduction to Municipal Bond Credit Analysis ~ Date: Wednesday, November 15, 2023 Description: An understanding of the principles of governmental accounting and financial reporting is an essential tool in the municipal analyst’s toolbox. This plain-language seminar is geared to the non-accountant – the person who uses financial statement information meaningfully for analyzing creditworthiness and making decisions – emphasizing the meaning of the information over debits and credits. It is ideal both for analysts who are relatively new and those with more experience who are looking for a refresher.

Speaker: Dean Michael Mead is a Partner at Carr, Riggs & Ingram CPAs and Advisors (CRI). Prior to joining CRI, Dean was on the staff of the Governmental Accounting Standards Board (GASB) for 24 years, most recently as Assistant Director of Research and Technical Activities. He also was an adjunct member of the Accounting and Information Systems faculty at Rutgers Business School, where he taught governmental accounting, auditing, and financial statement analysis. Dean was the author of the GASB’s award-winning User Guides and is a recipient of the NFMA’s Award for Excellence for his efforts to educate the municipal bond community through teaching and writing. He is a long-time member of NFMA and a member of the board of directors of the Southern Municipal Finance Society. Text: The GASB’s An Analyst’s Guide to Government Financial Statements, 3rd Edition is available free online and can be accessed here: AN ANALYST'S GUIDE TO GOVERNMENT FINANCIAL STATEMENTS—3RD EDITION (MARCH 2018). Healthcare and Higher Ed's "Triple Demographic Cliffs": Can these sectors help themselves while helping each other tackle the healthcare staffing crisis and tumbling higher education enrollment?Date: Thursday, November 2, 2023

Location: Ballard Spahr Description: Healthcare and higher education leaders nationwide are grappling with operational challenges exacerbated by three demographic tidal waves:

How are healthcare institutions meaningfully promoting increased labor capacity while managing the bottom line? What is the role of international students and staff in this picture? Is growing medical programs at higher education institutions a solution for both sectors? With so many new nursing and allied health programs emerging at colleges, is there enough capacity, or too much? What does it take for a higher education institution to successfully start or grow a medical program? What are some of the bottlenecks and issues to watch for in growing these programs? Panelists: With 3,000 licensed beds, the West Virginia University Health System (operating under the brand name WVU Medicine) is West Virginia’s largest private employer with 30,000 employees at 20 member hospitals and five institutes. Nick assumed the role of Chief Financial Officer (CFO) in July 2023 following roles as the CFO and Treasurer of Temple University Health System and in various leadership positions at UPMC Children’s Hospital of Pittsburgh. Nick was recognized in 2010 by Pittsburgh Magazine as one of Pittsburgh’s 40 under 40, and in 2021 as a CFO of the Year in the Rising Star category by the Philadelphia Business Journal. As consultant to 1,900 college campuses and nonprofits annually, Ruffalo Noel Levitz (RNL) has helped institutions enroll the students they want, graduate more students into success, and build lifelong relationships with donors. At RNL, Charles has supported hundreds of institutions, including some of RNL's largest partnerships, across the United States and Canada. He has guided these institutions to increase enrollment and sustainably grow revenues in the undergraduate, graduate, online and non-traditional markets. Charles' 27+ year expertise in enrollment management started at Saint Louis University. Recognized as one of the Philadelphia region’s leading universities, Widener University issued new money bonds in 2021 in part to renovate its Academic Tower North Building to house Widener's physical therapy, occupational therapy, speech therapy and physician's assistant programs. These programs are part of Widener's College of Health and Human Services for which Robin serves as Dean. Widener also operates a School of Nursing as one of eight total schools of the University. Linda's role as Widener's Vice President of Administration and Finance follows other higher education financial leadership roles including Assistant Vice President of Finance and Administration at LaSalle University and Director of Budget and Planning at the Wharton School of the University of Pennsylvania. Moderator: PhAMAS at the Phillies vs. Milwaukee Brewers

Date: Tuesday, July 18, 2023Time: Picnic starts at 5:35 pm. First pitch is at 6:40 pm. Location: Citizens Bank Park Sponsor: Thanks to Build America Mutual Prepaid Gas - Evolving Structure

Date: Wednesday, May 10, 2023

Location: Zoom or Description: Prepaid gas transactions are structured deals that provide savings for municipal gas and energy authorities, access to the municipal market for the guarantor and an investment opportunity for the buy-side. The sector has experienced substantial growth over the past several years, reaching nearly $50B in debt outstanding. This session will provide insights from the issuer, buy-side, and guarantor perspective regarding the structural components of the transactions. We will outline the benefits of these deals in the municipal marketplace and touch on the finer points of the evolving credit structure. ESG Impact in Municipal BondsDate: Thursday, April 13, 2023Time: 3:00 pm - 5:00 pm Location: Zoom or Description: ESG, as an investment approach can vary widely—some investors focus on assessing opaque risks, such as transition risk, others look for positive environmental or social impact. Green, social and sustainability bonds are tools that issuers of bonds can use to communicate positive environmental or social attributes of their financed activities. The additional transparency that should come with green, social and sustainability bonds allows investors to make informed decisions about alignment with their bespoke ESG strategies or investment mandates. This session will provide insights on labelled municipal bonds as well as observations on assessing risk mitigants and impact across the US municipal market. Featuring: Monica Reid Monica Reid is the Founder and Chief Executive Officer of Kestrel a leading provider of green bond services and ESG Impact Data for fixed income. Kestrel is the market leader for external reviews of green, social and sustainability bonds in US public finance and recently launched ESG Impact Data for the entire municipal market. Cailey Martin Cailey Martin is an ESG Analyst in Kestrel, who works across most sectors, and has experience in research, environmental science, and healthcare consulting. Ms. Martin holds a bachelor’s degree in chemistry and physics, and minor in energy and environment, from Harvard University. She is responsible for scoring, reviewing, and researching methodologies for Kestrel ESG Impact Data. Financial Data Transparency Act: What will it Mean for Municipal Credit Analysts?Date: Thursday, March 30, 2023Time: 3:00 pm - 5:00 pm Location: Description: The Financial Data Transparency Act (FDTA), which became law in late 2022, may significantly impact municipal disclosure and analytics once implemented. This session will provide a primer on structured data for municipal securities analysts, why structured data requirements are central to the FDTA, rulemaking and implementation timeline, how it will revolutionize the role of municipal analysts, and why it's critical that analysts participate in the standards development process. Featuring: 2023 Municipal Market OutlookDate and Time: Thursday, January 26, 2023, 3-5 pmLocation: Featuring: Tom Jackson, Manager, US Regional Economics, S&P Global Market Intelligence PhAMAS 2022 Holiday PartyDate and Time: Wednesday, December 21 from 5:00 - 8:00 pm Location: Ladder 15, 1528 Sansom Street Philadelphia, PA 19102 Constructing a Muni Bond DealPhAMAS hosted a discussion about constructing a municipal bond deal. Using a case study approach, our panel of experts briefly discussed the roles of each professional and then walked through the process of bringing municipal bonds to market, focusing on topics such as how to position an issue to sell to buyers, call structure, valuing municipal bond insurance, negotiating covenants and adapting to changing market conditions. The Impact of The Future of Work, Public Pensions and Domestic Politics on Public FinanceDate: Thursday, September 28, 2022 Time: 4:00 pm - 6:00 pm Format: In-person Presentation Location: Speaker: Higher Education Panel: Opportunities and Challenges for the Higher Education SectorDate: Thursday, June 16, 2022 Time: 3:00 pm - 5:00 pmFormat: In-person Roundtable Discusion Location: Panelists: Moderator: PhAMAS Night at the PhILLIESDate: Thursday, May 5, 2022 Time: Picnic starts at 5:35 pm and ends at 7:05. First pitch is at 6:45 pm. Location: Citizens Bank Park Cost: $20 for PhAMAS/NFMA members and $30 for non-members.

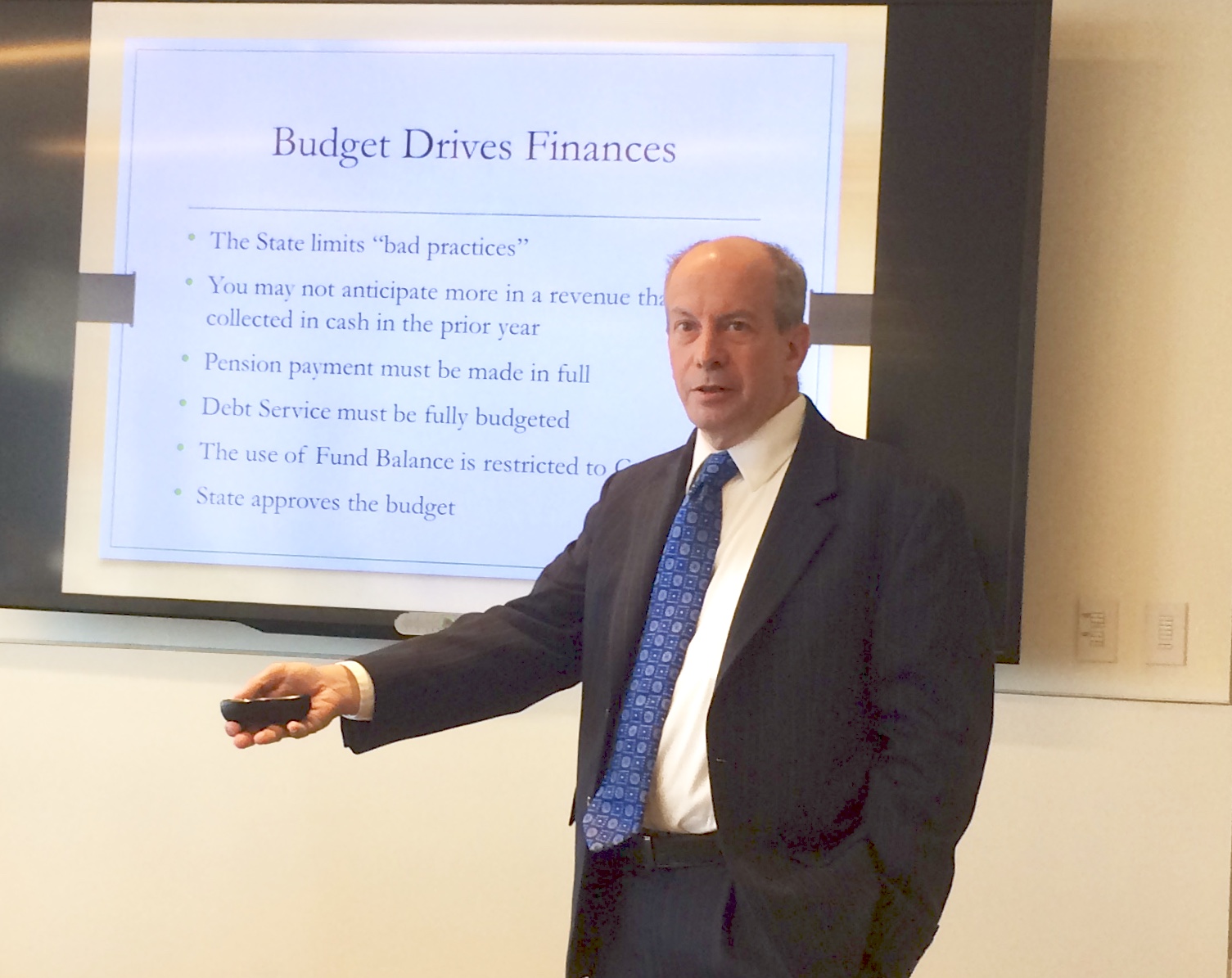

GASB Update and Q&ACo-sponsored by the California Society of Municipal Analysts and the Philadelphia Area Municipal Analyst SocietyDate: Thursday, March 17, 2022 Time: 12:00 - 1:30 pm ET (9:00 - 10:30 am PT) Speaker: Dean Michael Mead, CGFM, Assistant Director of Research and Technical Activities, Governmental Accounting Standards Board and Coordinator, Governmental Accounting Standards Advisory Council Click to download the powerpoint. 2022 Municipal Market OutlookThursday, January 13, 2022 Our panelists shared their views on the outlook for the municipal market and U.S. economy in 2022. Bonus: 3 SPGI U.S. economic reports: SPGI U.S. Economics Real-time report: U.S. Real-Time Data: Economic Activity Slows As Omicron Takes Center Stage PANELISTS: Beth Ann Bovino, U.S. Chief Economist, S&P Global Ratings Peter DeGroot, Managing Director, Municipal Research & Strategy, J.P. Morgan Tom Kozlik, Head of Municipal Research and Analytics, HilltopSecurities Inc. MODERATOR: Ted Molin, Vice President, Wilmington Trust Investment Advisors, Inc. 2021 Annual MeetingPhAMAS held its annual meeting on November 10, 2021 where the proposed slate of officers was approved. ESG: Risk vs. ImpactAs ESG becomes an increasing focus for issuers and investors, panelists will discuss how to frame ESG risk as well as how the shift to sustainable investing is expected to impact the market and future issuance. Kimberly Lyons, VP/Senior Analyst, Moody’s Investors Service View the Speaker Bios. High Yield CreditsDate: Thursday, November 5, 2020Time: 12:00 - 1:00 pm Format: Go To Webinar Although the multi-year restructuring of a certain Caribbean commonwealth continues to dominate headlines, 2019’s record low interest rates, positive municipal supply/demand dynamics, and credit spread compression continued into the investing environment in the beginning of 2020. This sentiment was then abruptly interrupted by the onset of the COVID-19 pandemic. In this environment, how can analysts/investors find appropriately priced high yield investments that are structured and positioned to withstand future challenges? What are the latest high yield credit developments of note? What are the signals that seasoned analysts will be watching going forward? What are some of the lessons learned in credit roughly 7 months after we left the “old normal” that we can arm ourselves with to enter the “new normal”? We ask that the audience be prepared with good questions and in turn be prepared for candor! New Frontiers of Data AnalysisDate: Wednesday, February 26, 2020 Time: 3:00 – 5:00 Location: Details: Municipal analysts are increasingly interested in the potential of new and emerging data and technology tools. In this session, you'll learn about: - Research efforts using Natural Language Processing (NLP) to identify risks in municipal disclosure - Developments in fully machine-readable structured muni data. Together, these trends stand to offer powerful new ways to access and utilize data and better understand municipal risk. **Please note that this event is closed to the press.** Presenters: Mark Schmidt, CFA, Vice President Municipal Research at Morgan Stanley. Mark Schmidt, CFA is a Vice President in Morgan Stanley’s Research Department. He is a member of the Municipal Fixed Income Strategy Team, which has been recognized by Institutional Investor’s All-America Fixed Income Research poll, as well as Smith’s Research & Gradings. As a Municipal Strategist, he analyzes market trends and data, conducts credit analysis, and writes research publications for client and firm use. He has also contributed to the firm’s Public Policy research efforts, with an emphasis on tax reform. Prior to joining the Research Department, he worked as a bond specialist for Morgan Stanley Wealth Management. Liz Sweeney was formerly managing director and criteria officer for US public finance at S&P Global. She is now President of Nutshell Associates, a municipal advisory, risk management, and credit training firm based in Baltimore. She is also on the faculty at Georgetown University's business school, a board member of the University of Maryland Medical System, and a member of the Standard Government Reporting working group, a collaborative industry-wide effort to bring machine readable standards and user-friendly technology to reporting by local, state, and federal governments. View Liz Sweeney's presentation. 2020 Municipal Market OutlookDate: Thursday, January 23, 2020 Time: 3:00 - 5:00 pm Location: Moderator: Eric Kazatsky, Head of Municipal Strategy, Bloomberg Intelligence Eric is responsible for creating municipal-focused research for Bloomberg Terminal clients. He has 18 years successful experience involving municipal bonds and has spent his career in various aspects of the industry including sell side, buy side and a large municipal issuer. Prior to Bloomberg, Eric served as an institutional desk strategist and municipal portfolio manager. Eric has a B.A. in finance and economics from the University of Pittsburgh, an M.B.A. in finance from St. Joseph’s University, and an M.S. in investment management from Temple University. Speakers: Mikhail Foux, Managing Director and Head of Municipal Strategy, Barclays Jason Hannon, Head of Municipal Strategy and Senior Fixed Income PM, Wilmington Trust Jason is responsible for developing tax-exempt fixed income strategy for Wilmington Trust Investment Advisors Inc. (WTIA), the investment advisory arm of Wilmington Trust and M&T Bank. He has more than a decade of experience in the investment industry, specializing in fixed income investments. Prior to joining Wilmington Trust, he was a vice president and portfolio manager at Emigrant Bank/New York Private Bank & Trust; a principal and senior trader at Arbor Research & Trading; and an associate and municipal bond trader at Vanguard. He holds a bachelor’s degree in finance from Pennsylvania State University and is a CFA®. Dan White, Director of Economic Research, Moody’s Analytics Dan is the director of government consulting and public finance research at Moody’s Analytics. In this role he oversees economic research with an emphasis on fiscal policy and municipal market impacts. He regularly presents to clients and conferences, and has been featured in a number of print, radio and televised media outlets, ranging from Bloomberg Television to the Wall Street Journal. Dan also works closely with a number of governments and policymakers in an advisory role and teaches as an adjunct professor of economics at Villanova University. Dan holds an MA in economics as well as undergraduate degrees in finance and international business from New Mexico State University. View Dan White's presentation. What Analysts Need to Know about Government Accounting - Presented by Dean Mead of GASB~ Presented by PhAMAS in conjunction with the NFMA's Introduction to Municipal Bond Credit Analysis ~ Date: Wednesday, November 20, 2019 Time: 8:00 am – 5:00 pm Location: KPMG Details: GASB’s Dean Mead will provide an educational seminar on the rules that state and local governments follow when accounting for and reporting their finances. During this in-depth discussion, participants can expect to hear:

Immediately following the workshop, PhAMAS will present a panel of speakers from across the Municipal Bond industry who will discuss their experience as Analysts from their respective positions. Panelists include:

Tour of Philadelphia International AirportDate: Thursday, October 10, 2019 Time: Tour begins at 10:00 am. Full details will be sent to those who register. Location: Philadelphia International Airport. Transportation to the Airport will NOT be provided. Details: Please join PhAMAS for a tour of the Philadelphia International Airport! Following the tour, our group will meet with several Airport officials. Lunch will be provided.

Tracy Borda, Chief Financial Officer and Janes Tyrrell, Chief Revenue Officer, of the Philadelphia Airport discuss the airport and answer questions with PhAMAS members and guests over lunch in the Control Tower. Back to School - Perspectives on Higher EducationDate: Thursday, September 26, 2019 Time: 3:00 - 5:00 pm Location: Details: Join us for a discussion with our esteemed panelists representing many perspectives from the higher education sector. Moderator: Panelists: Brian Fitzpatrick, Vice President, BAML

Join PhAMAS at the Phillies!Date: Wednesday, July 17, 2019 Time: Picnic starts at 5:35 pm, First pitch at 7:05 pm Location: Citizens Bank Park

Evolving Views Regarding Special Revenues –

|

|

|

Shelley Aronson of First River Advisory introduces the interactive and informational panel and also frames the discussion about the different strategies and merger & acquisition options hospitals may pursue to gain market share, grow operations, or remain viable. |

|

|

Daniel Ahern, EVP of Business Development and Strategy at Tower Health tells the story about the formation of the new System through the acquisition of five former for-profit facilities by flagship Reading Hospital. |

|

|

Christine Doyle, Managing Director in the Healthcare and Nonprofit Group at PFM Financial Advisors, provides insight into different strategies used by healthcare systems, including community hospitals. |

|

| Kevin Cunningham, Partner at Ballard Spahr, LLP discussing common structures of healthcare legal documents. |

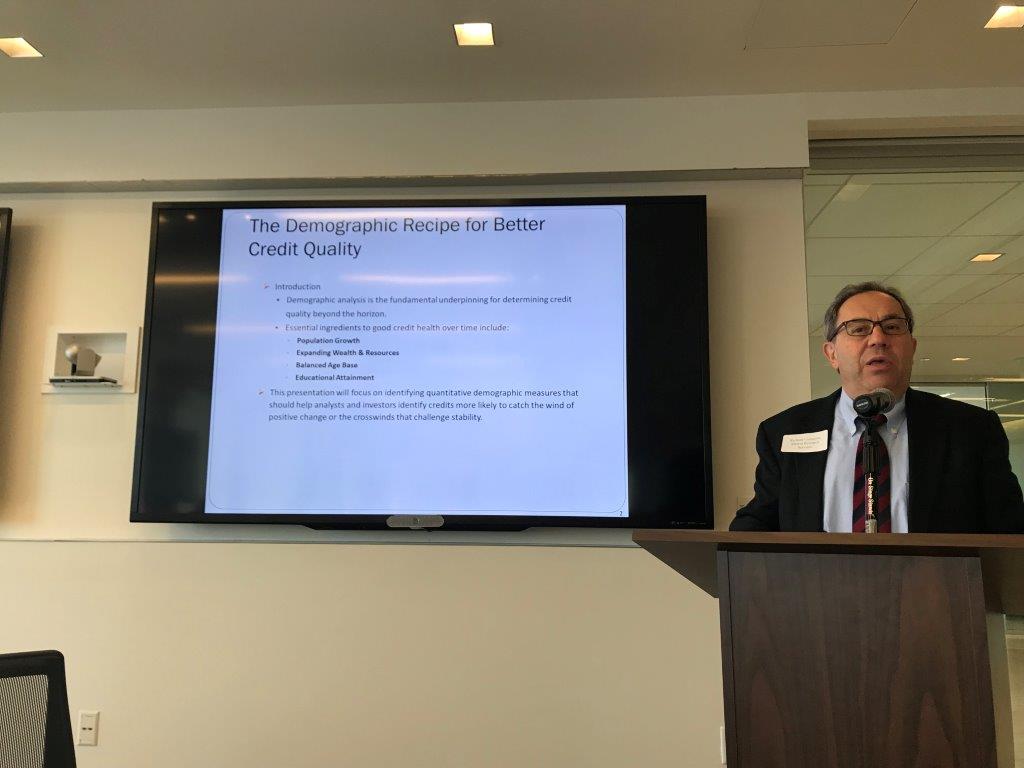

The Reality of Demographic Effects on Municipal Credit Quality

Date: Thursday, August 23, 2018

Time: 3:00 - 4:30 pm with a cocktail reception sponsored by Merritt Research Services, LLC and Investortools, Inc.

Location:

Ballard Spahr

1735 Market Street, 51st Floor

Philadelphia, PA 19103

Speaker: Richard Ciccarone, Merritt Research Services, LLC

Details:

Richard Ciccarone of Merritt Research Services, LLC will focus on the fundamental underpinning of demographic factors as the foundation for influencing credit quality now and in the future. The presentation will highlight quantitative demographic measures that help analysts and investors identify credits likely to catch the tailwind of positive changes or headwinds that can challenge fiscal stability. Using statistical financial metrics, Rich will examine whether preconceptions about the impact of demographic factors and trends actually play out relative to credit quality. Download the presentation.

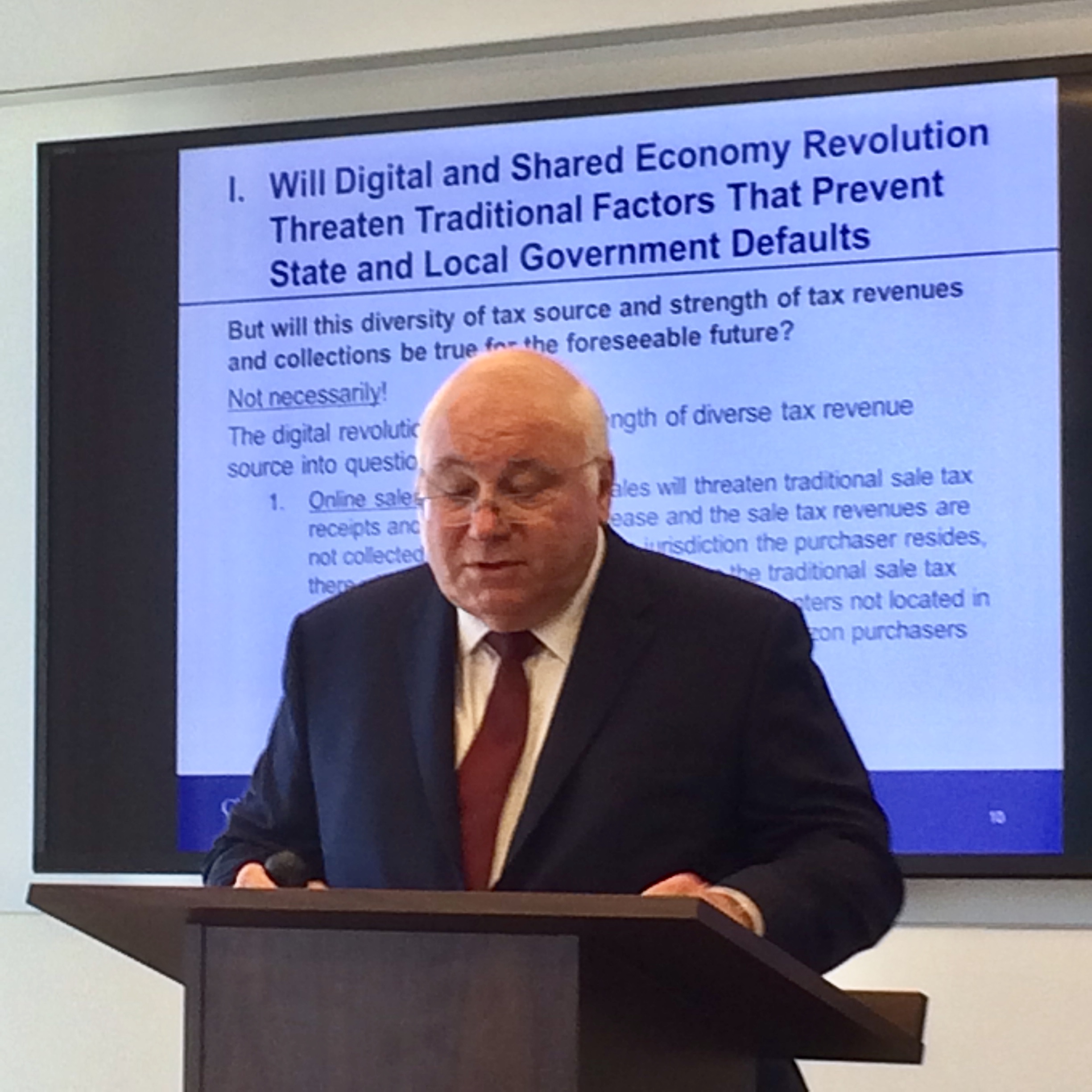

The Need to Return to the Basics of Municipal Financing -- Puerto Rico, PROMESA and Coming Attractions in the Land of Distress

Date: Wednesday, May 23, 2018

Time: 3:00 - 5:00 pm, with a cocktail reception to follow - sponsored by TMC Bonds

Location:

Ballard Spahr

1735 Market Street, 51st Floor

Philadelphia, PA 19103

Speaker: James Spiotto, Chapman Strategic Advisors LLC - Bio

Details:

Jim intends to speak for about an hour and have a discussion with participants for a second hour. He will discuss special revenue bonds and the Assured decision in Puerto Rico. See this article https://muninetguide.com/puerto-rico-assured-decision/ on "Why Pledged Revenues Are Required to Be Paid to Revenue Bondholders in Chapter 9 Municipal Bankruptcy and Why the Assured Decision in Puerto Rico’s PROMESA Title III Proceeding Should Be Reconsidered or Reversed on Appeal."

On January 30, 2018, the Court presiding over the Title III adjustment of debt proceeding for the Commonwealth of Puerto Rico and certain of its instrumentalities (including the Puerto Rico Highways and Transportation Authority (“PRHTA”)) entered a ruling on Assured Guaranty Corporation et al.’s Complaint requesting protection, relief and payment of pledged revenues (special revenues) of a revenue bond financing of PRHTA. The decision of the Court that pledged special revenues would not be paid during the Chapter 9 proceeding unless the municipality as debtor chooses to do so is contrary to the decisions or practices of the numerous Chapter 9 courts (including in Jefferson County, City of Stockton, Detroit, Sierra King Health Care District, San Jose School District and other Chapter 9 cases). No Chapter 9 bankruptcy court has interpreted Section 922(d) to prohibit the payment of pledged special revenues as collected to revenue bondholders during a Chapter 9. In the Jefferson County case, the timely payment of pledged revenues (special revenues) to the sewer bondholders was actively litigated and objected to by Jefferson County. The Chapter 9 bankruptcy court in the Jefferson County case specifically ruled in a series of decision that the net pledged revenues as defined in the revenue bond financing documents were to be timely paid to the bondholders as collected during the Chapter 9 case.

The MuniNetGuide.com Article linked here sets forth the justifications for the payment of pledged special revenues to revenue bondholders as supported by municipal law, the Constitutional restrictions on Chapter 9 and bankruptcy courts not to interfere with state legislative control over municipalities including mandated payments, the 1988 Amendments to Chapter 9 and the Chapter 9 Bankruptcy Court decisions and practices.

Powerpoint #1: PROMESA

Powerpoint #2: Lessons Learned

Cybersecurity Risks for the Municipal Sector

Date: Thursday, April 19, 2018

Time: 3:00 - 5:00 pm

Location:

Janney Montgomery Scott LLC

1717 Arch Street, 20th Floor

Philadelphia, PA 19103

Topic:

The increasing role of technology and automation in the municipal sector, while beneficial and widely expected, also comes with the cost of protecting infrastructure and technology systems. For localities it’s not just about securing data, but protecting the ability to deliver essential services. The recent cyber-attack on Atlanta’s systems has captured widespread media attention, highlighting that public finance entities are indeed targets.

The panel discussion will focus on cyber risks specific to the municipal sector, including states, local governments and related entities, utilities, transportation, and not-for-profit healthcare and higher education. The panelists will share insights into both the financial and reputational implications, vulnerabilities, and provide possible questions to consider when evaluating the likelihood and magnitude of the risk.

Featuring a distinguished panel assembled by Erin Ortiz of Janney Montgomery Scott, LLC.:

Geoff Buswick is a Managing Director and Sector Leader in the U.S. Public Finance - Governments team at S&P Global Ratings in Boston. Geoff speaks regularly on the topics of cybersecurity, sustainability, direct purchase bank loans, distressed credits, and specific aspects of the local government criteria. Prior to joining S&P Ratings in 2000, Geoff served as the Chief Financial Officer, Treasurer & Collector for the City of Gloucester, Mass. In addition, he spent three years as the Administrative Officer for the City of North Adams, Mass. Download Presentation.

Darin Murphy joined the FBI as a Special Agent in 2003.He has experience investigating a variety of cyber crimes including network intrusions, DDoS attacks, and Internet fraud. He has a master's degree in computer engineering and prior experience in semiconductor design.

Download Cyber Risk Sample Questions.

Tax Reform and its Impact on the Municipal Market

Date: Thursday, March 22, 2018

Time: 3:00 - 5:00 pm, with refreshments to follow

Location:

PFM Financial Advisors LLC

1735 Market Street, 42nd Floor

Philadelphia, PA 19103

Featuring a distinguished panel assembled and moderated by Erin Kelly of Vanguard who is a member of our Program Committee:

Jim D’Arcy, Senior Portfolio Manager, Vanguard

Tom Kozlik, Municipal Strategist, PNC Capital

Ellen Marshall, Principal, Marshall & Company

Topic: Electric Industry Transition Including Disruptive New Technologies Such as Battery Storage

Date: Thursday, January 18, 2018

Time: 3:00 - 5:00 pm, with a "Post-Holiday Reception" sponsored by Janney Montgomery Scott to follow

Location:

Janney Montgomery Scott LLC

1717 Arch Street, 20th Floor

Philadelphia, PA 19103

Featuring a distinguished panel assembled by Dan Aschenbach of Moody's:

Dan Aschenbach, Senior Vice President, Moody’s Investors Service will moderate the discussion and offer some perspective on cost recovery risk for public power electric utilities as electric transition takes place. Download Dan's presentation.

Michael Hagerty is a Senior Associate at The Brattle Group with experience in electricity wholesale market design, renewable and climate policy analysis, transmission planning and development, and strategic planning for utility companies. Michael has worked on several analyses in support of cost of new entry (CONE) estimates for ISO-NE and PJM. Michael has also focused on analyzing opportunities and challenges of existing and proposed renewable energy and climate policies, including the EPA’s Clean Power Plan (CPP), state-level Renewable Portfolio Standards (RPS), and California’s GHG cap-and-trade market. Mr. Hagerty holds a B.S in Chemical Engineering from the University of Notre Dame in South Bend, Indiana and an M.S. in Technology and Policy from the Massachusetts Institute of Technology in Cambridge, Massachusetts. Download Michael's presentation.

Tom Falcone is the CEO of the Long island Power Authority who is not only responsible for leading one of Nation’s largest utilities but has been at forefront of introducing new technology into the power grid. Tom will provide the context of the use of battery storage from the CEO utility perspective. Download Tom's presentation.

Emily Schapira, Executive Director of the Philadelphia Energy Authority is leading this major city’s efforts on solarizing Philadelphia and will discuss the opportunities and constraints on this effort including role of battery storage and solar. Download Emily's presentation.

Topic: Rainy Day Funds and State Credit Ratings: Presentation and Panel Discussion

Date: Thursday, September 21, 2017

Time: 4:00 - 6:00 pm

Location:

PFM Financial Advisors

1735 Market Street, 42nd Floor

Philadelphia, PA 19103

Refreshments will be served.

Presentation: Rainy Day Funds and U.S. State Ratings by Dr. Jon Moody, followed by a panel discussion led by Arnold Foundation’s Brenna Erford. Panelists include Baye Larsen from Moody's and Erin Kelly from Vanguard.

Topic: Trump: First 100 Days

Date: Thursday, July 27, 2017

Time: 4:00 - 6:00 pm

Location:

Ballard Spahr

1735 Market Street, 51st Floor

Philadelphia, PA 19103

Featuring:

George Friedlander, Managing Partner, Court Street Group Research

John Godfrey, Government Relations Director, American Public Power Association

Pension Risks Moving from Balance Sheets to Budgets

Date: Thursday, June 1, 2017

Time: 3:00 - 6:00 pm

Location:

Cozen O'Connor

1650 Market Street, 28th Floor

Philadelphia, PA 19103

Featuring:

Tom Aaron and Tim Blake, Moody's

Note: This event is closed to the press.

Sponsor: National Public Finance Guarantee

Inside the Mind of a Bankruptcy Expert: Thoughts on The Need for U.S. States to Access Bankruptcy and Puerto Rico's Status

Date: Wednesday, May 3, 2017

Time: 4:00 - 6:00 pm

Location:

PFM Financial Advisors

1735 Market Street, 42nd Floor

Philadelphia, PA 19103

Featuring:

David Skeel, UPENN Law, member of Puerto Rico Oversight Board

Note: This event is open to the press.

2017 Municipal Market Outlook

Date: Thursday, January 19, 2017

Time: 4:30 - 7:00 pm (the discussion will be in two parts with a networking break in-between)

Location:

Janney Montgomery Scott

1717 Arch Street

20th Floor

Philadelphia, PA 19103

Summary:

Join your industry colleagues for the Philadelphia Area Municipal Analyst Society’s 2017 Municipal Market Outlook. This year the format will be an Unconference - a free-form exchange of ideas among top industry leaders in a peer-to-peer learning session. Audience participation is encouraged throughout the sessions. Leading the discussion are:

· Sean Carney, BlackRock

· Natalie Cohen, Wells Fargo Securities

· Tom McLoughlin, UBS

· Tom Weyl, NPFG

· Matt Posner, Court Street

· Michael Zezas, Morgan Stanley

Stephen Winterstein from Wilmington Trust will serve as moderator.

Presentation and Holiday Party

Date: Thursday, December 1, 2016

Time: 5:30 - 8:00 pm

Drinks available from 5:30 to 6, Nathan will speak, take questions for about an hour, sign books and heavy appetizers and drinks will be served

Location:

Ballard Spahr LLP

1735 Market Street, 48th Floor

Philadelphia, PA 19103

Featuring:

Nathan Bomey, former Detroit Free Press reporter (now at USA Today)

Description:

Nathan Bomey covered the Detroit bankruptcy while at the Detroit Free Press. His book, Detroit Resurrected: To Bankruptcy and Back covers the filing, the negotiations and near-term results.

Sponsor: Assured Guaranty

Reception for Attendees of the NFMA Introduction to Credit Seminar

Date: Thursday, November 17, 2016

Time: 6:00 - 8:00 pm

Location:

Ladder 15

3rd Floor Private Room

1528 Sansom Street

Philadelphia, PA 19102

http://www.ladder15philly.com/

Featuring: Heavy hors d'oeuvres stations

Who's Invited: PhAMAS members, NFMA Intro Session Presenters, and Conference Attendees.

Sponsors: PhAMAS and National Public Finance Guarantee Corporation

The FBI and the Bernie Madoff Investigation

Date: Tuesday, September 20, 2016

Time: 12:00 - 1:30 pm

Location:

Racquet Club of Philadelphia

215 S 16th Street

Philadelphia, PA 19102

Hear from the FBI Case Agent who worked the notorious Bernard L. Madoff Investment Securities Ponzi Scheme investigation. Learn what it took to convict Madoff and his fraudster co-conspirators. Hear about aspects of the investigation not released to the public. Learn about some of the key players involved, and see photographs taken during search and seizures (including Madoff's office).

This fascinating case study will detail the complexities of an investment scandal that cost its victims billions of dollars, and the trial that resulted in the convictions of five defendants on thirty-one guilty counts.

Patrick J. Duffy is a Special Agent with the Federal Bureau of Investigation, Philadelphia Division. SA Duffy is currently assigned to a White Collar Crime Squad that specializes in Corporate and Securities Fraud, where his principal duties include the investigation of violations of federal securities laws. SA Duffy's cases include investigations of Insider Trading, Market Manipulations, and Ponzi schemes.

SA Duffy received a bachelor's degree in Accounting from LaSalle University in 2002. From 2002 to 2008, SA Duffy worked within the audit practice of KPMG, LLP Philadelphia where he was employed as an associate and senior associate on both public and private client engagements.

Sponsor: This program is co-produced by PhAMAS and CFA Society of Philadelphia. Visit them on the web at https://www.cfasociety.org/philadelphia/Pages/default.aspx.

Public Pension Day #2 (of 2), 2016

Date: Wednesday, July 13, 2016

Time: 10:00 am - 5:00 pm

Location:

Ballard Spahr, 1735 Market Street, 48th Floor, Philadelphia, PA 19103

Featuring:

Trends in Pension Funding around the US Post GASB 67 & 68, Les Richmond, Build American Mutual

Pension Reform: Lessons from Around the Country, Shannon D. Farmer, partner at Ballard Spahr

Review of New Pension Accounting Standards for GASB 67 & 68, Dean Mead, Research Manager at the Government Accounting Standards Board (GASB)

History and Politics of Pennsylvania Pensions, John D McGinnis, PA Representative for District 79 (Blair County, including Altoona)

Public Pension Day #1

Date: Thursday, June 9, 2016

Time: 9:00 am

Location: Janney Montgomery Scott, 1717 Arch Street, Philadelphia

Featuring:

Tom Aaron and Tim Blake from Moody's

Dr. Dan DiSalvo, CUNY and author of Government Against Itself, will give a presentation titled, "Pensions and Public Sector Unions: The politics of legacy costs."

Eugene DePasquale, Auditor General of Pennsylvania, will review his office's work on public sector pensions

Jay Hines ad Jeff Ammerman from the Pennsylvania Association of School Business Officials (PASBO)

Sponsored by: Assured Guaranty

A Compromise for Puerto Rico

Date: Friday, June 3, 2016

Time: 12:00 pm

Location: Janney Montgomery Scott, 1717 Arch Street, Philadelphia

Featuring: Kent Hiteshew, Director of the US Treasury Department's Office of State and Local Finance, who will discuss H.R. 5278 PROMESA

Sponsored by: PhAMAS

Philadelphia Academic Medical Centers: Transforming from Volume to Value

Date: Thursday, April 14, 2016

Time: 3:00 pm

Location: Cozen O'Connor, One Liberty Place, 1650 Market Street, Philadelphia

Featuring:

Herbert P. White, FHFMA, Assistant Vice-President at Temple Health

Dr. Daniel Quirk, Thomas Jefferson University Hospital

2016 Municipal Market Outlook

Date: Wednesday, February 17, 2016

Time: 4:00 pm

Location: Ballard Spahr LLP, 1735 Market Street, 51st Floor, Philadelphia

Featuring:

Blake Anderson, Managing Director, High Yield Securities, Mesirow Financial

Natalie Cohen, Head of Municipal Research at Wells Fargo, N.A.

Michael Zezas, Managing Director and Chief Municipal Strategist, Morgan Stanley

Sponsored by: National Public Finance Guarantee Corporation

Presentation and Holiday Party

Date: Thursday, December 10, 2015

Time: 4:00 pm

Location: Top of the Tower, 1717 Arch Street, Philadelphia

Featuring: Terry Smith, Founder and CEO of Smith's Research and Gradings

Sponsored by: Assured Guaranty

Accelerating Technological Change: Things for the Muni Market to Think About

Date: Thursday, November 19, 2015

Time: 4:00 pm

Location: Arch Auditorium on the University of Pennsylvania Campus, Philadelphia

Featuring: George Friedlander, Municipal Strategist, Citigroup

Hosted by: Fels Institute of Government

Politics and Public Opinion in Pennsylvania

Date: Wednesday, October 14, 2015

Time: 12:00 - 2:00 pm

Location: Ballard Spahr, 1735 Market Street, 48th Floor, Philadelphia

Featuring: G. Terry Madonna; Director of the Franklin & Marshall College Poll and Professor of Public Affairs at Franklin & Marshall College.

Sponsored by: Build America Mutual

The Municipal Information Age: New Media in the Municipal Bond Market (focus on Twitter)

Date: Thursday, October 1, 2015

Time: 11:00 am - 3:00 pm

Location:

PNC

1600 Market Street

Philadelphia, PA 19103

Featuring: Kristi Culpepper, State of Kentucky; Joe Mysak, Bloomberg

Sponsored by: National Public Finance Guarantee Corp.

What are the Newest Perspectives on Puerto Rico Bond Investing?

Date: Thursday, July 30, 2015

Panel Participants:

Alan Schankel, Janney Capital Markets (Moderator)

Dan Loughran, Oppenheimer Funds

Hector Negroni, Fundamental Advisors LP

Tom Weyl, National Public Finance Guarantee

Sponsor: National Public Finance Guarantee

April 9, 2015: US Public Pensions: Past Promises, Today’s Credit Challenge, by Moody’s Investor Service Tim Blake and Tom Aaron

January 15, 2015: 2nd Annual Municipal Analyst Market Outlook with presentations from: 2015 Municipal Outlook-- Tom Kozlik & 2015 Municipal Outlook- Chris Mier; Sponsored by BAM

November 4, 2014: Putting City Credit Quality Back Into the Spotlight -- The Post Detroit Aftershock - presentation by Rich Ciccarone of Merritt Research and Review of Creditscope Products

September 25, 2014: State of the Philadelphia Region's Housing Market by Dr. Kevin Gillen of the University of Pennsylvania

March 6th, 2014: 1st Municipal Analyst Market Outlook, Speakers included: Peter DeGroot from J.P. Morgan; John Hallacy from Assured; and Meghan Robson from Morgan Stanley; Sponsored by Assured Guaranty

Nov. 14, 2013: Nancy Winkler, Treasurer of the City of Philadelphia; Sponsored by Assured Guaranty